News

H2 forecast to 2050: The $850-B green game everybody wants to play

The emergence of a global H2 marketplace of about 6 times the current market size now looks inevitable. This is according to a new major study called Global H2 Market Forecast to 2050 published today by Rethink Energy, the energy intelligence arm of Rethink Technology Research.

Rethink is predicting that in 2050 the green H2 market will be valued at $850 B and the world will have installed over 5 TW of electrolysis capacity, feeding multiple industries from ammonia to shipping fuel to fertilizers, heavy duty trucking, aviation, steel making and both bio-fuel refining and methanol production.

All this will be achieved with the help of around 650 GW of electrolyzer manufacturing capacity, built between now and 2050. By that time the electrolyzer market will have made cumulative sales of $2 T which will represent quite a return on the cumulative investment of $111 B required by all the electrolyzer gigafactories.

Countries like the U.S., China, Australia, Chile plus Europe and a few African countries will dominate global supply and contribute to bringing down the global average cost of production for green H2 to around $1.5/kg by 2050.

This will in part be achieved due to an expected demand of 583 MMt in 2050, split between biofuel refining, ammonia production, methanol production, road transportation, aviation, steel manufacturing among other smaller uses.

Certain supply chain links might pose problems, especially scarce elements which are produced at scale in China. Other materials will see prices skyrocket because of increased demand, but all in all they won’t have a big final say in how the price of an electrolyzer will continue to drop.

Global H2 Market Forecast to 2050 also predicts that every color of H2 will play its part in sustaining the industry, as it scales. High future costs of nuclear power and natural gas will ensure that green H2 will be the only color left in play past 2039, when the entire industry will reach full sustainability.

The current thinking among H2 suppliers is that H2 will be a carbon copy of the LNG market. "The H2 industry is growing to the beat of the liquified natural gas (LNG) market," said Bogdan Avramuta, H2 analyst at Rethink Energy and lead author of the report, "many fossil fuel companies are looking at copying everything from the LNG industry from trading to shipping. H2 will become the next LNG."

"This is not to say that H2 will cover all the demand sectors that still rely on LNG, but rather it will amount to a considerable share of the global energy market as it will replace natural gas and oil (and coal) across multiple sectors," added Avramuta.

Pieces of fresh policy like the Inflation Reduction Act (IRA) or the EU Delegated Acts on Renewable H2 (Delegated Act) are some large-scale examples of contributions to a new rule book to manage the H2 industry.

The first piece of the puzzle in any green H2 project is the electrolyzer. A device that takes in water and electricity to produce H2. And where do electrolyzers come from? Electrolyzer gigafactories. Like Tesla’s gigafactories – which are industrial scale manufacturing facilities for batteries – an electrolyzer gigafactory is a plant that assembles electrolyzers.

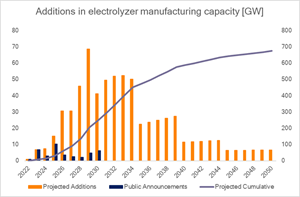

The global pipeline for such gigafactories currently sits at around 40 GW–a 1 GW gigafactory can manufacture 1 GW worth of electrolyzers in one year. All these have been publicly announced and have opening dates varying between 2023 and 2030.

"Geographically, Australia, the U.S., China, India and Europe represent the hotspots with the likes of Saudi Arabia, Morocco also getting involved. We expect the bias to fall towards these hotspots and for the gap in electrolyzer manufacturing capacity to grow between them and several fringe countries from around the world," said Avramuta.

The trend in investment in gigafactories is expected to follow a quick ramp up succeeded by a leveling off. Once the global capacity reaches around 247 GW in 2030, the install rate will saturate, and cumulative investment will plateau significantly after 2040.